Before we started traveling around the world, Sarah and I signed up for 14 credit cards worth 710,000 airline points. The big three airlines (United, Delta, American) sell intercontinental flights for 17,500 to 45,000 points, meaning we roughly obtained enough points for 20+ intercontinental flights. Alternatively, the points could have been used for 80-90 domestic flights.

Montana to South Africa for 40,000 Delta SkyMiles

The basics

In the United States, dozens of credit cards offer large sign-up bonuses, particularly the co-branded airline cards. Most require the cardholder to spend a minimum amount within three months of opening the card. Some have annual fees, often waived for the first year.

Co-branded airline cards and other cards

Co-branded airline credit cards add points to your individual airline accounts automatically. Other credit cards offer you points that can be transferred to individual airlines. These credit card points can be redeemed for many things, but the best value is usually for flights. Sometimes these points can be transferred to several airlines.

Lemurs in Madagascar to gold panning in the Yukon with 40,000 United points

Meeting the minimum spending requirements

Minimum spending requirements range between zero and thousands of dollars. To meet the spending requirements, Sarah and I figured out our normal spending patterns, and then focused our spending on each new card until we met the minimum.

For our wedding in March 2017, we knew we had a huge chunk of spending to allocate. We applied for several cards beforehand and paid for our reception with four different credit cards.

Candle holders = airline points

Tips for redeeming points

-

Domestic flights start at 7,500 points.

-

Point requirements increase by distance. From North America, South America is the cheapest intercontinental destination, followed by Europe, and then everywhere else.

-

Points flights require payment of taxes and fees, usually ~5-10 percent of the flight cost.

-

Points flights can sell out 3-4 months in advance for popular times but may be available on the same day during low periods.

-

International points flights from small towns (such as our hometown of Billings, MT) cost the same as flights from NYC or LAX, though availability is less.

-

United and American charge $75 for redeeming within three weeks of the flight.

Bonus restrictions

Each credit card company has its own rules about obtaining sign-up bonuses. Chase cards allow cardholders to obtain the same sign-up bonus every couple years if the card is canceled in between. American Express will never let you sign up for the same card twice. Chase will only issue a credit card to someone who has opened less than five credit cards in the last two years.

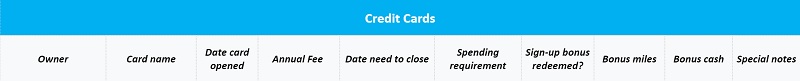

Tracking your credit cards

Opening and closing a bunch of credit cards requires some organization. To obtain most bonuses, you need to hit the spending requirement within three months. Several credit cards charge an annual fee but waive the fee for the first year. To avoid the annual fee, we cancelled most of our cards before one year. Sarah and I use a spreadsheet we share in Dropbox.

The heading of our credit card tracking spreadsheet

Responsible credit card use

The normal precautions about opening credit cards apply. We never carry a balance and we don’t change our spending patterns to achieve minimum spending requirements.

Opening and closing a bunch of credits will hurt your credit score in the short term. Assuming you pay your bills on time, your credit score should recover eventually. After opening and closing a dozen credit cards in the last couple years, my credit score is higher than it was at the beginning. Depending on your financial situation, opening a bunch of credit cards can be a bad idea, especially if you are planning to buy a home soon, have a history of credit card debt, or need to increase your spending to hit the minimum requirements.

To open this many accounts, you need to have a good credit score. Some card issuers are more selective than others. Credit Karma provides free credit score information to help you figure out your chances.

First glimpse of Africa on Delta flight from Atlanta to Johannesburg

Monitoring finances and figuring out your typical spending

To monitor our spending and finances, we use an online tool called Personal Capital. Sign-up for free using our link and we both get $20 Amazon credit. It takes less than five minutes. We found it handy for determining our typical spending and whether we would be able to reach minimum spending requirements.

As people who formerly worked on retirement policy, Sarah and I appreciate Personal Capital’s emphasis on saving for retirement

As people who formerly worked on retirement policy, Sarah and I appreciate Personal Capital’s emphasis on saving for retirement

Credit cards we opened

Credit card bonuses change semi-regularly, so some offers we used were slightly different. Many offers are also available with fewer points and lower minimum spending, but these are the ones with the biggest bonuses:

Credit card |

Points |

Annual fee |

Spending requirement |

Notes |

Citi American Airlines AAdvantage |

60k American points |

$95, waived for the first year |

$3000 in 3 months |

10% back on points redemptions |

Barclaycard AAdvantage Aviator Red World Elite Mastercard |

50k American points |

$95 |

One purchase in 3 months |

10% back on points redemptions |

American Express Platinum Delta SkyMiles Business |

70k Delta points +$100 statement credit |

$195 |

$3000 in 3 months |

|

American Express Gold Delta SkyMiles |

60k Delta points +$50 statement credit |

$95, waived for the first year |

$2000 in 3 months |

|

American Express Premier Rewards Gold |

50k Amex points +$100 airfare credit |

$195, waived for the first year |

$2000 in 3 months |

Points transferable to Delta, others. |

American Express Starwood Preferred Guest |

30k Starwood points |

$95, waived for the first year |

$3000 in 3 months |

Transfer 20k Starwood points to Delta or American for 5k point bonus |

Chase Sapphire Reserve |

50k Ultimate Reward points +$300 travel credit |

$450 |

$4000 in 3 months |

Points transferable to United, Southwest, others. Comes with Priority Pass. |

Chase United MileagePlus ® Explorer |

55k United points +$100 statement credit |

$95, waived the first year |

$3000 in 3 months |

Finding the best credit card offers

Plenty of websites dedicate themselves to monitoring the best credit card offers. We found these sites particularly useful for figuring out the best cards and providing links: The Points Guy, The Honeymoon Guy, and US Credit Card Guide.

One card we love is the Chase Sapphire Reserve. With a $450 annual fee, it’s only worth keeping after the first year if you fly a lot. The card includes a $300 annual credit for travel spending, offsetting most of the $450. The other big perk is Priority Pass, which gets you and a guest into fancy airport lounges all over the world with complimentary food and drinks (usually including alcohol). The card also provides a credit for Global Entry ($100) or TSA Pre Check ($85).

Time at the Cape Town Airport lounge passed a little too quickly

Final thoughts

Collecting points has been fun and helpful for offsetting our travel expenses. The Chase Sapphire Reserve Priority Pass turned long layovers into something we look forward to. Using free programs like Dropbox to create sharable spending spreadsheets and Personal Capital to see our net worth has helped us be financially responsible—and see the world. If you have any questions, please let us know in the comments.

Happy travels!

Note that this guide contains affiliate links, meaning that if you purchase something through the links, you are supporting us in the costs of running Two Fish Traveling. All the products that we discuss are ones that we use and love—like bug proofing our clothes with Permethrin to prevent malaria/dengue fever. We earn a small percentage of the sale at no extra cost to the purchaser.

The following two tabs change content below.

I am Sterling, one of the Two Fish Traveling. I love to travel and live in Polson, Montana with my wife Sarah.

Latest posts by Sterling Laudon (see all)

- How to Hike the Top of the Chinese Wall in the Bob Marshall Wilderness - March 28, 2023

- All of the bad things that happen when you travel - October 14, 2019

- Favorite countries of long-term travelers - August 8, 2019

Excellent post!!

Thank you, Tom!

Love the tips. With Aeroplan loosing its big partner Air Canada we are looking for just this sort of advice.

Thanks, Sarah! Hope it helps. Perhaps I will create a Canadian addendum one day 🙂